Essay

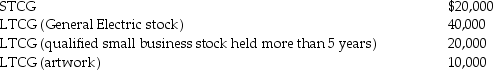

Tina, whose marginal tax rate is 33%, has the following capital gains this year:

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Definitions:

Related Questions

Q27: All of the following are true of

Q50: In community property states, income from separate

Q58: Individuals who actively participate in the management

Q70: All of the following items are deductions

Q75: Martha, an accrual-method taxpayer, has an accounting

Q93: For each of the following independent cases,

Q99: A loss incurred on the sale or

Q110: In October 2013, Joy and Paul separated

Q112: Gwen's marginal tax bracket is 25%. Gwen

Q114: Determine the net deductible casualty loss on