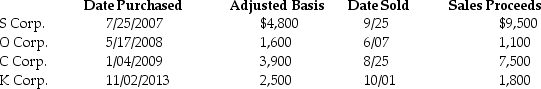

Mike sold the following shares of stock in 2014:

What are the tax consequences of these transactions, assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions, assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Definitions:

Cyanosis

A bluish or purplish discoloration of the skin and mucous membranes due to insufficient oxygen in the blood.

Buccal Mucosa

The inner lining of the cheeks, consisting of a mucus-secreting membrane, often examined in medical and dental evaluations.

Mucous Membranes

Moist layers of tissue lining various orifices and internal organs, such as the mouth, nose, eyelids, windpipe, and stomach, acting as a barrier against pathogens.

Presbyopia

A condition associated with aging in which the eye exhibits a progressively diminished ability to focus on near objects.

Q6: Toby, owner of a cupcake shop in

Q31: The vacation home limitations of Section 280A

Q33: Maria pays the following legal and accounting

Q36: One requirement for claiming a dependent other

Q44: Niral is single and provides you with

Q45: Kate can invest $4,000 of after-tax dollars

Q47: If a taxpayer suffers a loss attributable

Q71: Daniel purchased qualified small business corporation stock

Q76: In the Deferred Model, investment earnings are

Q82: For purposes of applying the passive loss