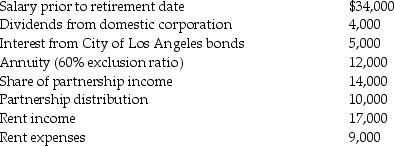

Jeannie, a single taxpayer, retired during the year, to take over the management of some rental property. She had the following items of income and expense:

What is Jeannie's adjusted gross income for the year?

What is Jeannie's adjusted gross income for the year?

Definitions:

Default Risk

The risk that a borrower will not make the required payments on their debt obligations.

U.S. Treasury Bonds

Long-term government debt securities issued by the United States Department of the Treasury with maturity periods over 20 years, offering a fixed interest rate.

Coupon Rate

The coupon rate is the annual interest payment made to bondholders, expressed as a percentage of the bond's face value.

Par Value

The nominal or face value of a bond, share of stock, or coupon as stated by the issuer; it is often a minimal amount like $0.01 or $1.00.

Q5: Melanie, a single taxpayer, has AGI of

Q48: Sari transferred an office building with a

Q53: A partnership's liabilities have increased by year-end.

Q56: Lindsay Corporation made the following payments to

Q61: A taxpayer had the following income and

Q78: Faye is a marketing manager for Healthy

Q86: Various members of Congress favor a reduction

Q86: Vincent, age 12, is a dependent of

Q124: Carla redeemed EE bonds which qualify for

Q130: Expenses related to a hobby are deductible