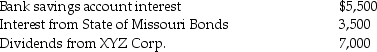

Kevin is a single person who earns $70,000 in salary for 2014 and has other income from a variety of investments, as follows:

Kevin received tax refunds when he filed his 2013 tax returns in April of 2014. His federal refund was $600 and his state refund was $300. Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2013 return. Due to changes in circumstances, Kevin is not itemizing deductions on his 2014 return.

Kevin received tax refunds when he filed his 2013 tax returns in April of 2014. His federal refund was $600 and his state refund was $300. Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2013 return. Due to changes in circumstances, Kevin is not itemizing deductions on his 2014 return.

Compute Kevin's taxable income for 2014.

Definitions:

Make-Or-Buy Analysis

An evaluation process used in business to determine whether products, parts, or components should be produced in-house or purchased from an external supplier.

Supply-Chain Strategies

Plans and methods developed to manage and improve the flow of goods and materials, information, and finances across the supply chain.

Standardized Data-Transmittal Format

A uniform method or protocol for sending and receiving data between different systems, ensuring compatibility and efficient processing.

Customization

The process of modifying products or services to meet specific customer requirements or preferences.

Q5: Liza's employer purchased a disability income policy

Q12: Alex is a calendar year sole proprietor.

Q20: The regular standard deduction is available to

Q23: Jamahl has a 65% interest in a

Q59: A shareholder's basis for the S corporation

Q69: Elise contributes $1,000 to a deductible IRA.

Q98: An S corporation distributes land to its

Q109: Nguyen Corporation, a calendar-year corporation, has a

Q109: Kevin is a single person who earns

Q122: At the election of the taxpayer, a