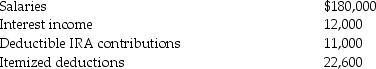

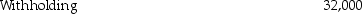

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2014. Both Bob and Brenda are age 32 and have no dependents.

a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax)?

e. What is the amount of their tax due or (refund due)?

Definitions:

ATP Production

The process of generating adenosine triphosphate, a molecule that stores and transfers energy within cells.

Lysosomes

Organelles in cells that contain enzymes to break down waste materials and cellular debris.

Peroxisomes

Organelles found in virtually all eukaryotic cells that contain enzymes involved in the detoxification of harmful substances and in metabolic pathways.

Vesicles

Small structures within cells that contain fluid or cytoplasm and are used for storing or transporting substances.

Q4: Normally, a security dealer reports ordinary income

Q11: Which of the following concerning implicit taxes

Q47: Internal Revenue Code Section 61 provides an

Q47: Crowley Corporation has the following income during

Q54: All of the following statements are true

Q62: Indicators of possible exposure of accumulated earning

Q64: Does Title 26 contain statutory provisions dealing

Q96: Reva is a single taxpayer with a

Q102: Lori had the following income and losses

Q104: Which of the statements is inaccurate regarding