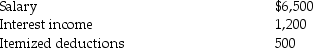

The following information for 2014 relates to Emma Grace, a single taxpayer, age 18:

a. Compute Emma Grace's taxable income assuming she is self-supporting.

a. Compute Emma Grace's taxable income assuming she is self-supporting.

b. Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Definitions:

Employee Empowerment

A strategy where employees are given the authority and resources to make decisions and contribute to the company's success.

Work Environments

Work environments encompass the physical and psychological conditions under which employees work, including the workspace, culture, and occupational health and safety standards.

Job Expansion

A strategy employed by organizations to increase the number and variety of tasks that an employee performs.

Labour Cost

Represents the total expense incurred by employers for the wages, benefits, and taxes associated with their workforce.

Q4: Ohio Corporation's taxable income for the current

Q4: Heidi invests $1,000 in a taxable bond

Q4: Lily had the following income and losses

Q9: Examples of income which are constructively received

Q10: A married couple need not live together

Q47: Crowley Corporation has the following income during

Q67: Joy purchased 200 shares of HiLo Mutual

Q88: After he was denied a promotion, Daniel

Q104: Many professional service partnerships have adopted the

Q121: The transfer of property to a partnership