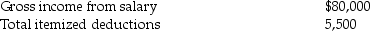

Steve Greene, age 66, is divorced with no dependents. In 2014 Steve had income and expenses as follows:

Compute Steve's taxable income for 2014. Show all calculations.

Compute Steve's taxable income for 2014. Show all calculations.

Definitions:

Direct Labor Variances

The differences between the actual costs of direct labor and the standard or expected costs, used for budgeting and cost control.

Direct Labor Workers

Employees who are directly involved in the production of goods or services.

Property, Plant, and Equipment

Long-term tangible assets held for business use and not expected to be converted to cash in the short term.

Variable Overhead Rate

Variable overhead rate is the cost per unit of indirect or overhead activities that vary with production volume, such as electricity for machinery.

Q23: The C Corporation Model is a variation

Q30: You may choose married filing jointly as

Q37: If certain requirements are met, Sec. 351

Q37: Assume that you want to read a

Q41: The wherewithal-to-pay concept provides that a tax

Q60: All costs of organizing a partnership can

Q64: Longhorn Partnership reports the following items at

Q74: Bryan Corporation, an S corporation since its

Q75: Married couples will normally file jointly. Identify

Q108: Steve and Jennifer are in the 33%