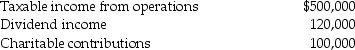

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions. The dividend income is from minor investments in U.S. publicly-traded stocks. Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions. The dividend income is from minor investments in U.S. publicly-traded stocks. Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Definitions:

Incentive

A factor, often a reward or a penalty, that motivates individuals or organizations to perform certain actions or behave in a desired way.

Loanable Funds

Funds available for borrowing in the financial market, influenced by interest rates and savings.

Interest Rate

The fee, represented as a percentage of the principal amount, that a lender imposes on a borrower for the utilization of assets.

Lend Money

The act of giving money to another party under the agreement that it will be repaid, often with interest, at a future date.

Q1: Suzanne, a single taxpayer, has the following

Q9: Tara transfers land with a $690,000 adjusted

Q11: All of the following statements are true

Q17: Sophia's employer is considering paying her either

Q17: Dozen Corporation is owned equally by twelve

Q20: The following are gains and losses recognized

Q24: The phrase "Entered under Rule 155" indicates

Q67: The number appearing immediately following the decimal

Q115: Juanita's mother lives with her. Juanita purchased

Q122: A family-owned corporation with substantial investment income