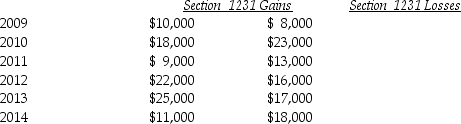

Lucy, a noncorporate taxpayer, experienced the following Section 1231 gains and losses during the years 2009 through 2014. Her first disposition of a Sec. 1231 asset occurred in 2009. Assuming Lucy had no capital gains and losses during that time period, what is the tax treatment in each of the years listed?

Definitions:

Self-determination Theory

A psychological theory focused on motivation that suggests people are most motivated to grow and change when their needs for autonomy, competence, and relatedness are fulfilled.

Intrinsic Motivation

The drive to engage in an activity for its own sake, due to the personal satisfaction and fulfillment it provides, without external incentives.

Extrinsic Motivation

Refers to motivation driven by external rewards such as money, fame, grades, and praise.

Intrinsic Motivation

The drive to engage in activities for their own sake, for the pleasure and satisfaction derived from participation, rather than for some separable consequence.

Q2: When returns are processed, they are scored

Q21: Ralph's business records were lost as a

Q27: If estimated tax payments equal or exceed

Q76: Small Corporation had the following capital gains

Q78: Which of the following businesses is most

Q89: The taxpayer need not pay the disputed

Q97: If each party in a like-kind exchange

Q103: Distinguish between an annotated tax service and

Q111: Discuss the basis rules of property received

Q123: Accrual-basis corporations may accrue a charitable contribution