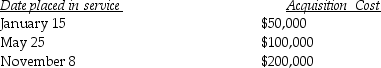

Mehmet, a calendar-year taxpayer, acquires 5-year tangible personal property in 2014 and does not use Sec. 179. Mehmet places the property in service on the following schedule:

What is the total depreciation for 2012?

What is the total depreciation for 2012?

Definitions:

Alfalfa

Alfalfa is a perennial flowering plant often used as forage for livestock due to its high nutrient content and adaptability to various climates.

Comparative Advantage

The ability of an individual or group to carry out a particular economic activity more efficiently than another activity.

Import

The purchase of goods or services from foreign producers, bringing them into one's home country.

Export

The sale of goods or services produced in one country to another country, contributing to a nation's gross domestic product.

Q10: The sale of inventory results in ordinary

Q15: A progressive tax rate structure is one

Q32: Upon acceptance, a formal job offer in

Q32: Of the three types of employee turnover,

Q50: Frederick failed to file his 2014 tax

Q67: Stellar Corporation purchased all of the assets

Q71: A corporation owns many acres of timber,

Q79: With a tight labor market, the organization

Q98: The unified transfer tax system<br>A)imposes a single

Q106: Ron's building, which was used in his