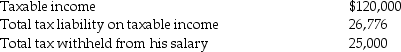

Frederick failed to file his 2014 tax return on a timely basis. In fact, he filed his 2014 income tax return on October 31, 2015, (the due date was April 15, 2015)and paid the amount due at that time. He failed to make timely extensions. Below are amounts from his 2014 return:

Frederick sent a check for $1,776 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2014. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,776 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2014. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Legitimate Interest

A recognized reasonable ground that an organization may have for processing personal data without needing consent under certain data protection laws.

Injunction

A court order requiring an individual or entity to do or cease doing a specific action.

Restriction

A limitation or constraint placed on actions, activities, or movements, often found in legal contexts or agreements.

Employment Agreement

A contractual agreement between an employer and employee outlining the terms of employment.

Q8: Although applicants probably do sometimes fake their

Q10: Increasingly, organizations are emphasizing _ as a

Q12: Alan files his 2014 tax return on

Q40: Practical significance is the sign of a

Q57: Decreasing numbers of staffing jobs are found

Q57: If an organization wishes to comply with

Q70: A taxpayer who uses the cash method

Q75: Which of the following is true regarding

Q77: The Senate equivalent of the House Ways

Q96: The additional recapture under Sec. 291 is