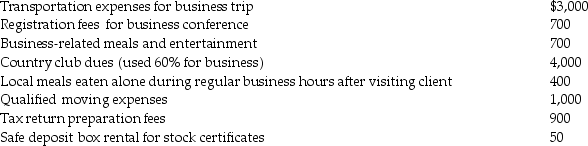

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were unreimbursed unless otherwise indicated:  In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation for the dues. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition, Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation for the dues. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Wealth

A measure of the value of all the assets of worth owned by a person, community, company, or country.

Income

The monetary payment received for goods or services, or from other sources, as rents or investments.

Inequality

The existence of unequal opportunities and rewards for different social positions or statuses within a group or society.

Intergenerational Mobility

The changes in social status that occur from one generation to another within a family or community.

Q21: A review of the 2015 tax file

Q58: Which of the following statements regarding abbreviations

Q63: Which of the following pairs is NOT

Q71: Different pronunciations of medical terms are acceptable.

Q75: Which of the following statements is incorrect

Q97: Personal travel expenses are deductible as miscellaneous

Q99: Wesley completely demolished his personal automobile in

Q104: Fines and penalties are tax deductible if

Q117: Which of the following types of muscle

Q119: Dana paid $13,000 of investment interest expense