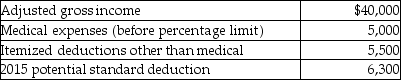

A review of the 2015 tax file of Gregory, a single taxpayer who is age 40, provides the following information regarding Gregory's 2015 tax status:  In 2016, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

In 2016, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

Definitions:

Donald Trump

The 45th President of the United States, serving from January 2017 to January 2021, known for his business background, controversial policies, and significant impact on American politics.

Lawrence v. Texas

A landmark 2003 Supreme Court decision that struck down sodomy laws in the US, advancing LGBTQ rights.

National Security Agency

A U.S. government agency responsible for global monitoring, collection, and processing of information and data for foreign intelligence and counterintelligence purposes.

Edward Snowden

A former National Security Agency contractor who disclosed to the public extensive internet and phone surveillance by US intelligence.

Q1: Nina includes the following expenses in her

Q13: Ellie, a CPA, incurred the following deductible

Q42: Jamal, age 52, is a human resources

Q47: During the current year, Donna, a single

Q52: Which of the following items will result

Q54: Which of the following is not required

Q59: Unless the alternate valuation date is elected,

Q84: Which of the following pairs is NOT

Q91: Ola owns a cottage at the beach.

Q135: Stella has two transactions involving the sale