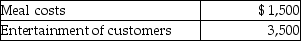

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be attended by many potential customers. During the week of the convention, Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various dinners, and that the entertainment is on the same day as the meetings with customers. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for the year is $50,000, and while he itemizes deductions, he has no other miscellaneous itemized deductions. What is the amount and character of Steven's deduction after any limitations?

Definitions:

Q2: What two conditions are necessary for moving

Q13: Taxpayers may not deduct interest expense on

Q34: Bone and cartilage are types of nervous

Q40: Medical expenses are deductible as a from

Q65: A medical expense is generally deductible only

Q67: Mickey has a rare blood type and

Q67: Determine the net deductible casualty loss on

Q104: Fines and penalties are tax deductible if

Q122: Rajiv, a self-employed consultant, drove his auto

Q182: A suffix that means surgical fixation is