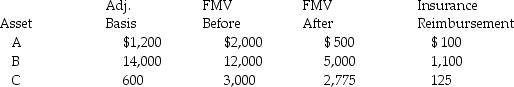

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2015 and the following occurred:  A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March. C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Horticulturist

A professional or expert involved in the practice of horticulture, focusing on the cultivation of plants for food, comfort, and aesthetic purposes.

Bermuda Grass

A type of durable, warm-season grass known for its resilience and commonly used in lawns, sports fields, and golf courses.

ANOVA

Analysis of Variance, a statistical method used to test differences between two or more means.

Fertilizer

Substances added to soil to supply nutrients that aid in plant growth, available in organic or synthetic forms.

Q50: Punitive damages are taxable unless they are

Q50: Nate sold two securities in 2015: <img

Q63: Which of the following pairs is NOT

Q79: Which of the following is most likely

Q85: Coretta sold the following securities during 2015:

Q89: An accrual-basis taxpayer may elect to accrue

Q90: Gina owns 100 shares of XYZ common

Q113: Capital expenditures add to the value, substantially

Q119: The initial adjusted basis of property depends

Q121: Liz, who is single, lives in a