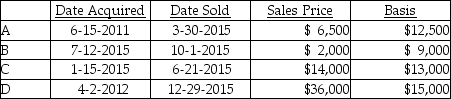

Coretta sold the following securities during 2015:  What is Coretta's net capital gain or loss result for the year?

What is Coretta's net capital gain or loss result for the year?

Definitions:

Teratogens

Agents that can cause congenital abnormalities or increase the incidence of an anomaly in a fetus when a mother is exposed during pregnancy.

Blastocyst

An early stage of embryonic development characterized by a fluid-filled sphere made up of 50-150 cells, occurring before implantation into the uterine lining.

Placenta

An organ in pregnant female mammals that nourishes and maintains the fetus through the umbilical cord.

Proximodistal Development

A pattern of growth where physical development starts at the center of the body and moves towards the extremities.

Q1: Losses on sales of property between a

Q11: During the year, Cathy received the following:

Q20: The tax law encourages certain forms of

Q45: A wash sale occurs when a taxpayer

Q54: Tia is a 52-year-old an unmarried taxpayer

Q77: Discuss tax planning considerations which a taxpayer

Q84: Tucker (age 52) and Elizabeth (age 48)

Q84: Linda was injured in an automobile accident

Q104: If property received as a gift has

Q139: The regular standard deduction is available to