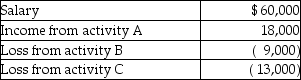

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy. Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years. During the year, Nancy sells activity C and realizes a $15,000 taxable gain. What is Nancy's AGI as a result of these transactions?

Definitions:

Differential Cost

The difference in total cost that will result from selecting one alternative over another in a decision-making situation.

Differential Cost

The difference in total cost that will result from selecting one choice over another.

Additional Cost

Expenses incurred that are above and beyond the initial forecast or budget for a project or product.

Differential Revenue

The difference in revenue generated under two different scenarios or as a result of a specific action.

Q11: In a community property state, jointly owned

Q12: The total worthlessness of a security generally

Q15: Taxpayers are allowed to recognize net passive

Q20: Christopher, a cash basis taxpayer, borrows $1,000

Q21: A review of the 2015 tax file

Q26: Gwen traveled to New York City on

Q37: Points paid to refinance a mortgage on

Q63: Which of the following pairs is NOT

Q70: Jeffrey, a T.V. news anchor, is concerned

Q134: Galvin Corporation has owned all of the