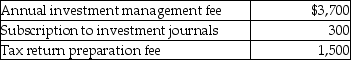

Nina includes the following expenses in her miscellaneous itemized deductions before application of the 2% of AGI floor:  Nina's AGI is $100,000. How much of the above-noted expenses will reduce her net investment income?

Nina's AGI is $100,000. How much of the above-noted expenses will reduce her net investment income?

Definitions:

Eversion

Turning outward.

Inversion

Turning inward.

Plantar Flexion

The movement that decreases the angle between the sole of the foot and the back of the leg, as in pointing the toes.

Coracobrachialis

A muscle in the upper arm that facilitates flexion and adduction of the arm.

Q4: Which of the following suffixes does NOT

Q8: Sacha purchased land in 2010 for $35,000

Q25: A taxpayer has made substantial donations of

Q25: Which combining form means skin?<br>A) dermat/o<br>B) gynec/o<br>C)

Q46: Pat, an insurance executive, contributed $1,000,000 to

Q51: Richard traveled from New Orleans to New

Q51: On December 1, 2015, Delilah borrows $2,000

Q82: Edward incurs the following moving expenses: <img

Q99: In September of 2015, Michelle sold shares

Q140: Tessa is a self-employed CPA whose 2015