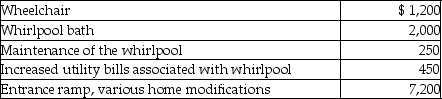

Alan, who is a security officer, is shot while on the job. As a result, Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength. Alan's physician recommends that he install a whirlpool bath in his home for therapy. During the year, Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000. Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000. Alan's deductible medical expenses (before considering limitations based on AGI) will be

Definitions:

Consideration

In contract law, it's the value that is exchanged between parties in a contract, making the agreement legally binding.

Agency Relationships

A relationship in which one party (the agent) agrees to act for another party (the principal) in a business transaction.

Ratification

The act of giving formal consent or approval to something, making it officially valid, typically in the context of contracts or agreements.

Agency Relationship

A legal and consensual arrangement where one party, the agent, acts on behalf of another, the principal, in dealings with third parties.

Q4: When a taxpayer has NSTCL and NLTCG,

Q8: Gina is an instructor at State University

Q12: Bob owns 100 shares of ACT Corporation

Q13: Amanda, who lost her modeling job, sued

Q16: Which of the following is NOT part

Q37: Kim currently lives in Buffalo and works

Q65: Ross works for Houston Corporation, which has

Q88: A small business uses the accrual method

Q90: During the current year, Lucy, who has

Q117: Investment interest expense which is disallowed because