Multiple Choice

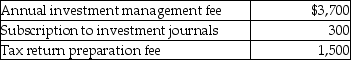

Nina includes the following expenses in her miscellaneous itemized deductions before application of the 2% of AGI floor:  Nina's AGI is $100,000. How much of the above-noted expenses will reduce her net investment income?

Nina's AGI is $100,000. How much of the above-noted expenses will reduce her net investment income?

Definitions:

Related Questions

Q6: "No additional cost" benefits are excluded from

Q33: Amounts collected under accident and health insurance

Q59: Meals may be excluded from an employee's

Q60: Tom and Shawn own all of the

Q62: Which term means movement away from the

Q102: John is injured and receives $16,000 of

Q106: If property that qualifies as a taxpayer's

Q116: Why did Congress enact restrictions and limitations

Q116: Tyne is a 48-year-old an unmarried taxpayer

Q164: Which prefix does NOT stand for a