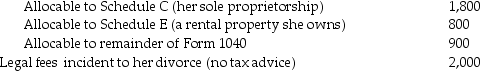

During the current year, Lucy, who has a sole proprietorship, pays legal and accounting fees for the following:  Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency  Tax return preparation fees:

Tax return preparation fees:  What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Thymosin

A hormone produced by the thymus gland, involved in the development and differentiation of T-cells in the immune system.

Imperative

Imperative refers to something of vital importance or necessity that demands attention or action.

Vocative

The vocative case is a grammatical feature used to denote direct addressing of someone or something, typically seen in languages that have a case system.

Passive

A grammatical voice where the subject of the sentence is the recipient of an action rather than the performer.

Q4: Eva and Lisa each retired this year

Q18: Van pays the following medical expenses this

Q31: Which of the following pathologies is caused

Q38: Jason, who lives in New Jersey, owns

Q39: Martha, an accrual-method taxpayer, has an accounting

Q45: A wash sale occurs when a taxpayer

Q48: Stacy, who is married and sole shareholder

Q49: Characteristics of profit-sharing plans include all of

Q52: Nancy reports the following income and loss

Q114: Which of the following is true about