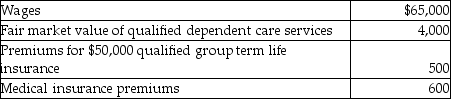

Carl filed his tax return, properly claiming the head of household filing status. Carl's employer paid or provided the following to Carl:  How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

Definitions:

Inefficiency

A situation in which resources are not used in the most productive way, leading to wasted inputs or suboptimal output.

Output

The total amount of goods or services produced by a firm or economy.

Taxed Away

Refers to the reduction in income or resources that occurs as a result of taxation.

Deadweight Loss

The loss of economic efficiency that occurs when the equilibrium for a good or service is not achieved or is not achievable.

Q1: Liz and Bert divorce and Liz receives

Q29: Nick and Nicole are both 68 years

Q48: A widow or widower may file a

Q50: The annual tax reporting form filed with

Q64: CT Computer Corporation, a cash basis taxpayer,

Q72: Over the years Rianna paid $65,000 in

Q83: Which of the following is least likely

Q93: Net long-term capital gains receive preferential tax

Q108: Section 1221 specifically states that inventory or

Q139: Douglas and Julie are a married couple