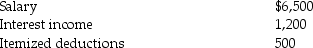

The following information for 2015 relates to Emma Grace, a single taxpayer, age 18:  a. Compute Emma Grace's taxable income assuming she is self-supporting.

a. Compute Emma Grace's taxable income assuming she is self-supporting.

b. Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Definitions:

Fixed Manufacturing Overhead

These are production costs that do not change with the level of production output, such as rent for factory buildings or salaries for factory management.

Overhead Applied

The portion of estimated manufacturing overhead cost that is charged to individual jobs based on the predetermined overhead rate.

Denominator Level

Refers to the total amount of capacity or activity base used to allocate fixed costs to products or services in cost accounting.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead to products or job orders, calculated at the beginning of a period by dividing estimated overhead costs by an estimated activity base.

Q11: During the year, Cathy received the following:

Q57: A taxpayer owns 200 shares of stock

Q62: The following are gains and losses recognized

Q70: Daniella exchanges business equipment with a $100,000

Q72: An office building owned by Abby and

Q99: In September of 2015, Michelle sold shares

Q101: Except in a few specific circumstances, once

Q105: The nonrefundable disabled access credit is available

Q112: All tax-exempt bond interest income is classified

Q121: In 2012, Leo's wife died. Leo has