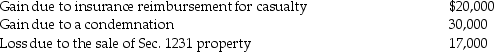

The following are gains and losses recognized in 2015 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.  A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

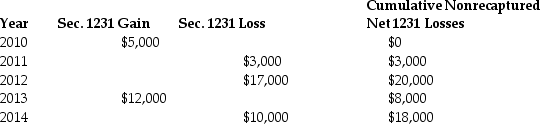

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:  Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Maintenance Stage

In behavior change models, the phase where new behaviors are consolidated into everyday practice, with the goal of preventing relapse into old habits.

Career Stage Model

A framework that outlines the various phases an individual goes through in their professional life, from entry-level positions to retirement.

Establishment Stage

A phase in one's career or the lifecycle of an organization during which stability and growth are pursued after initial achievements or setup.

Person's Career

The progression and actions of an individual's professional life, including job experiences, education, and advancements.

Q4: Sally divorced her husband three years ago

Q19: Chloe receives a student loan from a

Q25: Under UNICAP, all of the following overhead

Q32: In order to shift the taxation of

Q36: Thomas dies in the current year and

Q42: Bob owns a warehouse that is used

Q84: Gross income may be realized when a

Q99: On January 3, 2012, John acquired and

Q110: Beth and Jay project the following taxes

Q122: The filing status in which the rates