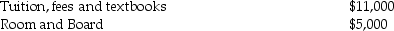

Tom and Anita are married, file a joint return with an AGI of $165,000, and have one dependent child, Tim, who is a first-time freshman in college. The following expenses are incurred and paid in 2015:  What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

HVAC Dealers

Businesses that specialize in selling, and often installing and servicing, heating, ventilation, and air conditioning systems.

All-Expenses-Paid Trip

A vacation or trip where all the costs, including travel, accommodations, and often meals and activities, are paid for in advance by the provider.

Pull Strategy

A marketing approach where a company focuses on creating demand for a product, encouraging consumers to actively seek out and buy the product.

Push Strategy

A marketing approach where businesses push their products to be seen by consumers, typically through advertising and promotions, rather than waiting for consumer interest.

Q3: Natasha, age 58, purchases an annuity for

Q8: Deborah, who is single, is claimed as

Q14: For 2015, unearned income in excess of

Q33: Which entities may elect a fiscal year?

Q72: If the accumulated depreciation on business equipment

Q76: Bret carries a $200,000 insurance policy on

Q77: The installment sale method can be used

Q81: Discuss the tax planning techniques available to

Q100: The unified transfer tax system, comprised of

Q110: The oldest age at which the "Kiddie