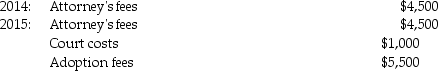

Tyler and Molly, who are married filing jointly with $210,000 of AGI in 2015, incurred the following expenses in their efforts to adopt a child:  The adoption was finalized in 2015. What is the amount of the allowable adoption credit in 2015?

The adoption was finalized in 2015. What is the amount of the allowable adoption credit in 2015?

Definitions:

Anger and Hostility

Emotional states where anger involves upset or displeasure, and hostility often includes aggressive attitudes and behaviors.

Coronary Risk

The likelihood or risk factors associated with the development of coronary heart disease, a condition characterized by reduced blood flow to the heart muscle.

Type A Personality

A personality style marked by a strong competitive orientation, impatience and urgency, and anger and hostility.

Transient Mental Stress

Refers to temporary states of emotional or psychological stress that come and go, not lasting permanently.

Q12: Under what circumstances can a taxpayer obtain

Q14: When corporate and noncorporate taxpayers sell real

Q17: Land, buildings, equipment, and common stock are

Q17: An exchange of inventory for inventory of

Q23: Hong earns $127,300 in her job as

Q32: Tom and Heidi, husband and wife, file

Q78: Amber supports four individuals: Erin, her stepdaughter,

Q88: Sec. 179 tax benefits are recaptured if

Q106: In computing AMTI, adjustments are<br>A) limited.<br>B) added

Q125: Kevin is a single person who earns