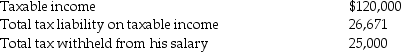

Frederick failed to file his 2015 tax return on a timely basis. In fact, he filed his 2015 income tax return on October 31, 2016, (the due date was April 15, 2015) and paid the amount due at that time. He failed to make timely extensions. Below are amounts from his 2015 return:  Frederick sent a check for $1,671 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2015. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,671 in payment of his liability. He thinks that he has met all of his financial obligations to the government for 2015. For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Time Period Assumption

An accounting principle that the life of a business can be divided into discrete time periods, such as months and years, for reporting purposes.

Operating Cycle

The duration of time it takes for a company to purchase inventory, sell the goods, and collect cash from the sale.

Dividends Declared

A firm's announcement of the payment of a dividend to shareholders by a specified date, representing a commitment to distribute a portion of earnings.

Net Income

The net income of a company, calculated by removing all costs and taxes from the total sales.

Q1: Because prices are slow to move in

Q5: When an involuntary conversion is due to

Q12: In April 2015, Emma acquired a machine

Q15: Frederick failed to file his 2015 tax

Q45: Between 1981 and 1981, Canada experienced _.<br>A)

Q53: What are the objectives of quantitative easing?

Q59: Fred purchases and places in service in

Q69: According to the household liquidity effect, higher

Q107: Everything else held constant, a decrease in

Q111: The all-events test requires that the accrual-basis