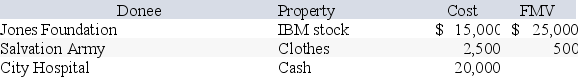

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock has been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock has been owned for 10 years.

Definitions:

Lengel-Daft Contingency Model

A theory that suggests the effectiveness of information richness in communication varies with the nature of the task or situation.

Media Richness Hierarchy

A theory that ranks communication media according to their capacity to convey information effectively and accurately, with richer media being more capable of handling complex messages.

Face-To-Face Communication

Direct interaction between people in the same location, often considered the most effective form of communication.

Lean Media

An approach to media production and consumption that emphasizes minimalism, eliminating wastage, and focusing on value from the perspective of the end user.

Q11: Which of the following is not true

Q27: Adjusted taxable income is defined as follows

Q36: David purchased a deli shop on

Q36: Campbell, a single taxpayer, has $400,000 of

Q63: Carly donated inventory (ordinary income property)to a

Q80: The Olympians have three children.The kiddie tax

Q107: The Inouyes filed jointly in 2019.Their AGI

Q112: A taxpayer instructing her son to collect

Q117: A taxpayer may not qualify for the

Q143: Taxpayers are not required to file a