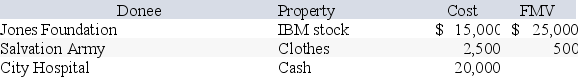

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock has been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year.You may assume that the stock has been owned for 10 years.

Definitions:

Acoustic

Relating to sound or the sense of hearing, often used to describe music that is performed or recorded without electrical amplification.

Media Richness

The ability of a communication medium to effectively convey information and promote understanding, often involving the use of multiple channels like text, audio, and video.

Animation

The process of creating the illusion of motion and change by rapidly displaying a sequence of static images that minimally differ from each other.

Marketing Website

A website designed specifically for promoting and selling products or services, often including features like product descriptions, promotional materials, and purchase capabilities.

Q4: Which of the following is a description

Q5: This year, Benjamin Hassell paid $20,000 of

Q19: Adjusted taxable income for calculating the business

Q28: Qualified education expenses for purposes of the

Q35: Rochelle, a single taxpayer (age 47), has

Q54: The alternative depreciation system requires both a

Q63: All of the following are tests for

Q81: Which of the following is a true

Q101: If there is not enough gross tax

Q141: In X8, Erin had the following capital