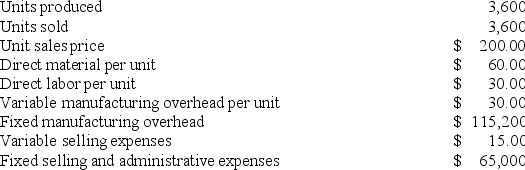

Aspen Inc has the following information for its first year of operations:

a.Prepare Aspen's full absorption costing income statement.

a.Prepare Aspen's full absorption costing income statement.

b.Prepare Aspen's variable costing income statement.

Definitions:

Ability-To-Pay

A concept in taxation that taxes should be levied according to an individual or entity’s ability to shoulder the tax burden.

Lump-Sum Tax

A tax that is the same for everyone, regardless of any actions people take.

Ability-To-Pay Principle

A taxation principle suggesting that taxes should be levied according to an individual's or entity's capability to bear the tax burden.

Tax Revenue

The income gained by governments through taxation.

Q36: In recording the purchase of materials that

Q36: Carter,Inc.produces two different products,Product A and Product

Q48: Jackson Inc.produces leather handbags.The production budget for

Q57: Volume-based cost systems tend to:<br>A)under-cost low-volume products

Q65: McGown Corp.has the following information: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7948/.jpg"

Q91: Hamilton,Inc.manufactures units in two processes: Production and

Q102: Cost-volume-profit analysis can only be performed for

Q103: Which of the following statements is correct

Q106: Restore Corp.produces three products,and is currently facing

Q132: During the last fiscal year,XYZ organization implemented