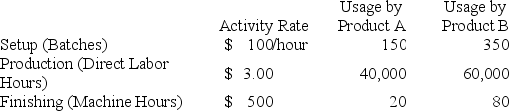

Harwell,Inc.produces two different products,Product A and Product B.Harwell uses a traditional volume-based costing system in which direct labor hours are the allocation base.Harwell is considering switching to an ABC system by splitting its manufacturing overhead cost of $400,000 across three activities: Setup,Production,and Finishing.Under the traditional volume-based costing system,the predetermined overhead rate is $4.00/direct labor hour.Under the ABC system,the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Outside Supplier

A third-party entity that provides goods or services to a company, typically not affiliated with the purchasing company.

Opportunity Cost

The expense incurred by not choosing the second-best option during decision-making.

Managerial Decision

Choices or judgments made by managers in the context of strategic planning and resource allocation to achieve business objectives.

Short-term

Referring to a period of time typically less than one year, used in context of planning, finance, or objectives.

Q1: Carmen moved to a new town and

Q16: Palm,which uses the high-low method,had an average

Q34: Mohave,Inc.produces approximately 4,000 units per month,and it

Q43: For each of the following independent cases,compute

Q54: A large company that uses activity based

Q62: Irwin Corp.has fixed costs of $20,000 and

Q67: Curtis Inc.uses a job order costing system.Manufacturing

Q77: The cost of not doing something is

Q82: Manufacturing overhead was estimated to be $400,000

Q99: Pinnacle Consulting employs two CPAs,each having a