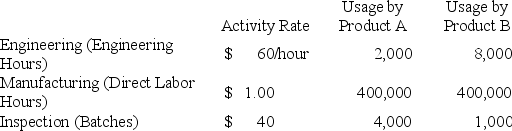

Hayden,Inc.produces two different products,Product A and Product B.Hayden uses a traditional volume-based costing system in which direct labor hours are the allocation base.Hayden is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,600,000 across three activities: Engineering,Manufacturing,and Inspection.Under the traditional volume-based costing system,the predetermined overhead rate is $2.00/direct labor hour.Under the ABC system,the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Weighted-Average Method

An inventory costing method that calculates cost of goods sold based on the weighted average cost of all items available for sale.

Equivalent Unit

An equivalent unit is a concept used in cost accounting to denote the amount of work done on units of production expressed in terms of fully completed units, facilitating the calculation of costs in a process costing environment.

Fabricating Department

A division within a manufacturing company where raw materials are assembled or processed into finished goods.

FIFO Method

An inventory valuation method (First-In, First-Out) where the oldest items in inventory are sold or used first.

Q17: Last month Stagecoach Company had a $60,000

Q21: Prevention costs are incurred to prevent quality

Q40: Underwood,Inc.manufactures two products.It currently has 2,000 hours

Q43: For each of the following independent cases,compute

Q68: Payton Corp.has sales of $200,000,a contribution margin

Q69: When direct materials are used in production

Q77: Raul noticed that when he saw other

Q98: Franklin,Inc.has two divisions,Seward and Charles.Following is the

Q124: An activity that is performed for each

Q140: Adobe Music Company,which manufactures wooden and metal