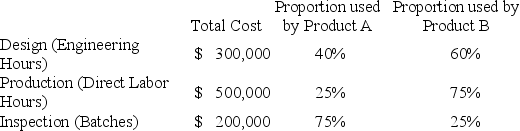

Carter,Inc.uses a traditional volume-based costing system in which direct labor hours are the allocation base.Carter produces two different products: Product A,which uses 100,000 direct labor hours,and Product B,which uses 300,000 direct labor hours.Carter is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,000,000 across three activities: Design,Production,and Inspection.Under the traditional volume-based costing system,the predetermined overhead rate is $2.50/direct labor hour.Under the ABC system,the cost of each activity and proportion of the activity drivers used by each product are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Social Introversion

A personality trait characterized by a preference for solitary activities and situations above social interactions.

Response Inventories

Tests designed to measure a person’s responses in one specific area of functioning, such as affect, social skills, or cognitive processes.

Face Validity

The extent to which a test or measure appears effective in terms of its stated aims, based on subjective judgment rather than empirical evidence.

Development Cycle

Refers to a series of stages through which a project, product, individual, or organism passes during its lifetime, encompassing phases from initiation to completion or birth to death.

Q22: Maple Inc.manufactures a product that costs $45

Q44: Lynwood,Inc.produces two different products (Product A and

Q45: In the past 50 years,the importance of

Q59: Livingston Co.uses process costing to account for

Q80: Elk Corp.has sales of $300,000,a contribution margin

Q82: Royal Enterprises has presented the following information

Q98: Frost,Inc.is a service firm that uses process

Q106: Consider a winery that employs eight people

Q128: Hamilton,Inc.has two divisions,Parker and Blaine.Following is the

Q130: All else being equal,if sales revenue doubles,variable