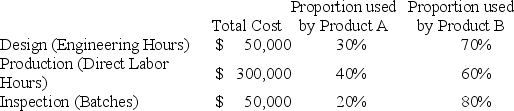

Harwell,Inc.uses a traditional volume-based costing system in which direct labor hours are the allocation base.Harwell produces two different products: Product A,which uses 40,000 direct labor hours,and Product B,which uses 60,000 direct labor hours.Harwell is considering switching to an ABC system by splitting its manufacturing overhead cost of $400,000 across three activities: Setup,Production,and Finishing.Under the traditional volume-based costing system,the predetermined overhead rate is $4.00/direct labor hour.Under the ABC system,the cost of each activity and proportion of the activity drivers used by each product are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Unrealized Profits

Profits that have been earned but not yet realized through a transaction, such as an increase in value of an asset that has not been sold.

Intercompany Sales

Transactions involving the exchange of goods or services between subsidiaries within the same parent company.

Mark-Up

The amount added to the cost price of goods to cover overhead and profit, resulting in the selling price.

Effective Tax Rate

The true percentage of earnings that a person or business pays to the government, determined by dividing their total tax contribution by their taxable income.

Q9: Which of the following represents the cost

Q22: Frost,Inc.is a service firm that uses process

Q26: A predetermined overhead rate is calculated by

Q45: An equivalent unit is a measure used

Q46: Which of the following is NOT one

Q81: Ragtime Company had the following information for

Q83: Which of the following statements is correct

Q96: Break-even units can be found by dividing

Q103: Last month Angus Company had a $30,000

Q126: Full absorption costing divides fixed overhead between