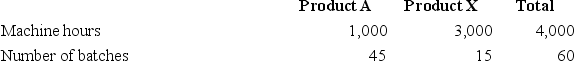

Lynwood,Inc.produces two different products (Product A and Product X) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The activity rate for Machining is $125 per machine hour,and the activity rate for Inspection is $500 per batch.The activity drivers are used as follows:  What is the amount of Inspection cost assigned to Product A?

What is the amount of Inspection cost assigned to Product A?

Definitions:

U.S. Tax Liability

The total amount of tax owed to the United States government, including federal, state, and local taxes.

Foreign Tax Credit

A tax credit that reduces the tax liability of an individual or entity for certain taxes paid to foreign governments.

Form 1116

A tax document used to claim foreign tax credit that reduces double taxation by the United States on income earned abroad.

Passive Income

Income earned from rental property, limited partnerships, or other enterprises in which a person is not actively involved.

Q20: Moss,Inc.currently processes payroll in its accounting department,which

Q41: Each individual indirect cost should be assigned

Q55: The decision-making approach that focuses on factors

Q60: Which of the following types of reports

Q66: Profit will be the same under variable

Q81: Ragtime Company had the following information for

Q95: Variable costing uses a contribution margin income

Q99: Hamilton,Inc.manufactures units in two processes: Production and

Q110: When units are sold,the cost associated with

Q129: Washington,Inc.produces two different products (Product C and