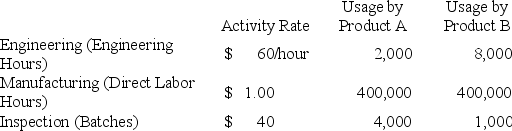

Hayden,Inc.produces two different products,Product A and Product B.Hayden uses a traditional volume-based costing system in which direct labor hours are the allocation base.Hayden is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,600,000 across three activities: Engineering,Manufacturing,and Inspection.Under the traditional volume-based costing system,the predetermined overhead rate is $2.00/direct labor hour.Under the ABC system,the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a.Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b.Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system.

c.Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d.Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e.Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Tax Burden

The total amount of taxes paid by an individual, corporation, or sector, often expressed as a percentage of income or GDP.

Price Paid

The amount of money exchanged for a good or service.

Consumers

Individuals or groups that purchase goods and services for personal use.

Excise Tax

A specific tax levied on the sale or consumption of particular goods, such as alcohol, tobacco, and gasoline.

Q4: Trout,Inc.prepared the following production report:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7948/.jpg"

Q26: The high-low method provides a reasonable estimate

Q37: Manufacturing overhead was estimated to be $200,000

Q42: Deer currently manufactures a subcomponent that is

Q44: A firm with a higher degree of

Q49: A cost object is:<br>A)an item for which

Q53: Lynwood,Inc.produces two different products (Product A and

Q84: Manor,Inc.currently manufactures 1,000 subcomponents per month in

Q98: Manufacturing overhead was estimated to be $200,000

Q100: Appraisal or inspection costs are costs that:<br>A)are