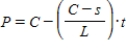

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $4,100 and has a scrap value of $1,700 after 5 years, write an equation to represent the present value after t years.

Definitions:

Supervision

The act of overseeing and directing work or workers.

Authoritarian

Pertaining to a governing or leadership style characterized by absolute or dictatorial control, often with little regard for individual freedom or input.

Establish and Enforce

The process of setting up rules or principles and ensuring their observance by applying penalties for violations.

Authoritative Parents

Parents who are both demanding and responsive, they set clear standards for their children but also encourage independence and are attentive to their needs.

Q3: Trimethoprim and sulfamethoxazole (Septra) suspension contains 200

Q14: A parabolic archway has the dimensions shown

Q22: Two cards are drawn from a deck

Q23: Thoth, an ancient Egyptian god of wisdom

Q27: Consider the set<br><br>A = {distinct letters in

Q32: Sketch the curve. <br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Sketch

Q46: Find the sum of the first 12

Q49: Graph the first-degree inequality in two unknowns.

Q92: Find the probability of obtaining exactly two

Q114: What does the circuit symbol in the