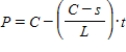

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $6,100 and has a scrap value of $2,300 after 5 years, graph the amount you will have in t years. What is the slope of the graph?

Definitions:

10th Grade

A stage in the U.S. education system typically referring to the second year of high school education, attended by students around 15-16 years old.

Grouped Frequency Distribution

A method of displaying data by specifying the number of occurrences in each group of data.

Intervals

Continuous ranges of values or categories between two points, often used to specify confidence levels in statistics or musical distances in music.

Equal Size

Describes groups or samples having the same quantity or measure.

Q22: The diameter of an electric cable is

Q28: Let R, F, L, B, T, U

Q31: R, F, L, B, T, U mean

Q37: What does the circuit symbol in the

Q40: What is the probability that two people

Q54: Find the sum [A] + [B], if<br>

Q54: Show the result of the moves on

Q57: A collection of coins has a value

Q117: Use the tautology <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7816/.jpg" alt="Use the

Q136: Using gates, design a circuit for the