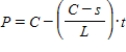

A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

If a certain piece of equipment costs $6,100 and has a scrap value of $2,300 after 5 years, graph the amount you will have in t years. What is the slope of the graph?

Definitions:

Short-Term Memory

The capacity for holding a small amount of information in mind in an active, readily available state for a short period of time.

George Miller

A cognitive psychologist best known for his theory that the capacity of human memory is approximately seven items, plus or minus two.

State Capital

The city or town that functions as the administrative seat of government for a state.

Semantic Memory

A type of long-term memory involving the capacity to recall words, concepts, or numbers, which is essential for the use and understanding of language.

Q3: Evaluate the expression below to two decimal

Q10: A patient's physician orders read, "Cisplatin 20

Q11: If row 7 of a matrix [A]

Q28: The student nurse is preparing to give

Q50: Solve the system by the Gauss-Jordan method.

Q51: An oil-drilling company knows that it costs

Q70: Krinkles potato chips is having a "Lucky

Q83: A researcher chooses three leaves from a

Q93: Use the sample space shown in the

Q147: Translate the sentence into if-then form. All