TABLE 16-5

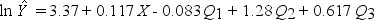

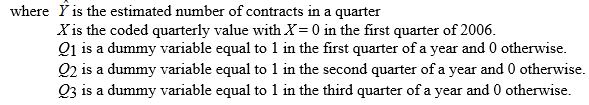

A contractor developed a multiplicative time-series model to forecast the number of contracts in future quarters, using quarterly data on number of contracts during the 3-year period from 2006 to 2008. The following is the resulting regression equation:

-Referring to Table 16-5, using the regression equation, which of the following values is the best forecast for the number of contracts in the third quarter of 2009?

Definitions:

Gross Margin

A company's total sales revenue minus its cost of goods sold (COGS), divided by total sales revenue, expressed as a percentage.

Fixed Costs

Expenses that do not change with the level of goods or services produced by a business, such as rent, salaries, and insurance premiums.

Sales Increase

A rise in the number of products or services sold, often indicating a growth in a company's business activities and revenue.

Risk/Reward Tolerance

An individual's or entity’s capacity to assume risk with the expectation of receiving a corresponding return, balancing between potential gains and losses.

Q29: Referring to Table 15-5, which of the

Q31: An airline wants to select a computer

Q41: Referring to Table 16-7, the number of

Q45: Data on the amount of money made

Q46: Referring to Table 16-5, the best interpretation

Q58: Referring to Table 16-6, a centered 3-year

Q61: Referring to Table 16-7, the number of

Q75: Referring to Table 17-3, suppose the analyst

Q101: The following is the list of MAD

Q137: Referring to Table 14-15, which of the