TABLE 16-13

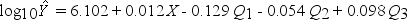

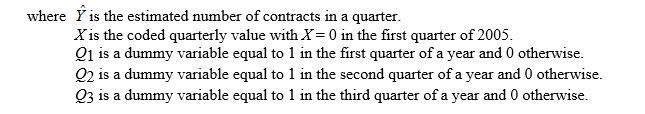

A local store developed a multiplicative time-series model to forecast its revenues in future quarters, using quarterly data on its revenues during the 4-year period from 2005 to 2009. The following is the resulting regression equation:

-Referring to Table 16-13, to obtain a forecast for the first quarter of 2009 using the model, which of the following sets of values should be used in the regression equation?

Definitions:

Slope Approaches

Techniques used to determine the direction and rate of change in data, often applied in statistical and economic models.

Stock's Price

The current market value at which a share of a particular stock can be bought or sold.

Black-Scholes Formula

A mathematical model developed for pricing options, estimating the variation over time of financial instruments.

Risk-free Interest Rate

The return on investment with no risk of financial loss, typically represented by government bonds.

Q2: Referring to Table 14-6, the estimated value

Q9: The opinions (classified as "for", "neutral" or

Q34: Photorespiration is<br>A) not a problem, because oxygen

Q49: Based on the residual plot below, you

Q61: Referring to Table 14-11, which of the

Q66: Referring to Table 16-8, the forecast for

Q81: Referring to Table 17-4, suppose the supervisor

Q93: Referring to Table 14-7, the department head

Q125: Referring to Table 13-10, what is the

Q145: Referring to Table 13-10, what are the