TABLE 16-13

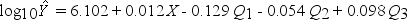

A local store developed a multiplicative time-series model to forecast its revenues in future quarters, using quarterly data on its revenues during the 4-year period from 2005 to 2009. The following is the resulting regression equation:

-Referring to Table 16-13, to obtain a forecast for the first quarter of 2009 using the model, which of the following sets of values should be used in the regression equation?

Definitions:

Interest Rate

Rate at which one can borrow or lend money.

Decline

A decrease in quantity, quality, or strength over a period, often observed in economic indicators, stock prices, or physical capacities.

Interest Rate

The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding.

Present Value

The current worth of a future sum of money or stream of cash flows, given a specified rate of return.

Q4: What hypothesis was being tested in the

Q14: Referring to Table 15-5, what is the

Q27: On an evolutionary tree, any group that

Q29: How does a scientific theory differ from

Q32: In autumn, the leaves of deciduous trees

Q52: Referring to Table 17-4, suppose the supervisor

Q58: Referring to Table 17-9, an <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4634/.jpg"

Q71: Referring to Table 17-8, an R chart

Q104: Referring to Table 14-7, the department head

Q111: Referring to Table 16-6, construct a centered