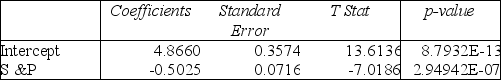

TABLE 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500, then it is possible to reduce the variability of the portfolio's return. In other words, one can create a portfolio with positive returns but less exposure to risk.

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons, which are believed to be negatively related to the S&P 500 index, is collected. A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y) on the returns of S&P 500 index (X) to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance. The results are given in the following Excel output.

Note: 2.94942E-07 = 2.94942*10⁻⁷

-Referring to Table 13-7, to test whether the prison stocks portfolio is negatively related to the S&P 500 index, the measured value of the test statistic is

Definitions:

Sexual Identity

A person's identification with, or sense of belonging to, a particular gender or sexual orientation.

Birth Control

Methods and devices used to prevent pregnancy or to control the timing of pregnancy.

Policies

Established guidelines, rules, or procedures designed by organizations or governments to guide decisions and achieve rational outcomes.

Sexual Identity

Sexual identity refers to how individuals perceive themselves and what they call themselves based on whom they are attracted to emotionally and sexually.

Q13: Referring to Table 12-11, if the null

Q22: Referring to Table 15-5, what is the

Q22: Referring to Table 11-2, the within groups

Q29: Referring to Table 13-5, the partner wants

Q48: Referring to Table 16-12, using the first-order

Q51: Referring to Table 12-5, what is the

Q52: The degrees of freedom for the F

Q72: Referring to Table 12-9, there is sufficient

Q137: Referring to Table 14-15, which of the

Q213: Referring to Table 14-15, what is the