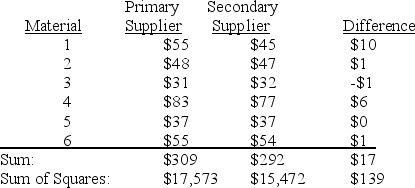

TABLE 10-8

A buyer for a manufacturing plant suspects that his primary supplier of raw materials is overcharging. In order to determine if his suspicion is correct, he contacts a second supplier and asks for the prices on various identical materials. He wants to compare these prices with those of his primary supplier. The data collected is presented in the table below, with some summary statistics presented (all of these might not be necessary to answer the questions which follow) . The buyer believes that the differences are normally distributed and will use this sample to perform an appropriate test at a level of significance of 0.01.

-Referring to Table 10-8, the test to perform is a

Definitions:

Tax Expense

The amount of taxation a company is required to pay to various tax authorities, based on its earnings.

SUTA Tax Payable

The liability owed by employers to the state for the State Unemployment Tax Act, used to fund unemployment benefits.

Payroll Tax Expense

Payroll Tax Expense is the employer's cost associated with the employment of staff, including taxes such as social security and Medicare taxes that must be paid based on salaries.

Wages Payable

A liability account representing the amount owed to employees for work performed but not yet paid.

Q15: Referring to Table 8-12, what is the

Q27: Referring to Table 7-1, what is the

Q62: The owner of a local nightclub has

Q92: Referring to Table 12-17, what are the

Q93: If we are testing for the difference

Q110: In testing for the differences between the

Q120: Referring to Table 8-4, the critical value

Q141: In instances in which there is insufficient

Q146: A sampling distribution is a distribution for

Q183: Referring to Table 10-7, the computed t