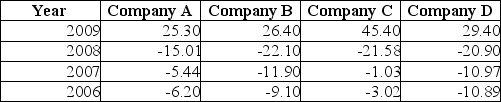

TABLE 3-8

The time period from 2006 to 2009 saw a great deal of volatility in the value of stocks. The data in the following table represent the total rate of return of our companies from 2006 to 2009.

-Referring to Table 3-8, calculate the geometric mean rate of return for Company D.

Definitions:

Trading Security

A financial instrument, such as stocks or bonds, held by an entity for the purpose of selling them in the near term to generate income through price appreciation.

Voting Common Stock

Shares that give the holder the right to vote on corporate policy and make decisions affecting the company's governance.

Net Income

The ultimate financial benefit a company receives after revenue has been adjusted for expenses and taxes.

Bond Investment

Purchasing of bonds as a way to generate income through interest payments, with potential for capital gains.

Q9: A _ is a vertical bar chart

Q38: Which of the following methods is used

Q44: Referring to Table 3-2, the five-number summary

Q48: Suppose A and B are mutually exclusive

Q49: Referring to Table 4-8, if a randomly

Q52: If you have inserted a gene in

Q73: Referring to Table 5-3, the standard deviation

Q87: Which of the following is NOT a

Q118: To evaluate two categorical variables at the

Q146: Referring to Table 6-2, John's commission from