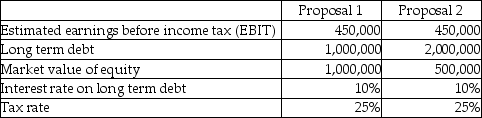

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Requirements

Requirements

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE ~ net income after taxes / market value of equity; net income after taxes = (EBIT - interest on long-term debt)× (I - tax rate).)

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Definitions:

Implicit Propositions

Ideas or assertions that are assumed within an argument but not directly stated.

Virtuous

Characterized by or exhibiting virtue, moral excellence, or righteousness.

Society

A group of individuals involved in persistent social interaction, or a large social grouping sharing the same geographical or social territory, typically subject to the same political authority and dominant cultural expectations.

Hypothetical Proposition

A statement in logic that suggests a conditional relationship between two propositions, where one is the consequence of the other.

Q2: A company earns $490,000 in pre-tax income,while

Q8: Regression and Discriminant analyses are computationally similar

Q8: Which of the following are advantages of

Q9: With a database, marketers cannot profile prospective

Q12: Experiential marketing is broadly defined and aimed

Q17: The following are some of the

Q25: What are positive and negative covenants? Give

Q44: All of the following are true about

Q58: A major advantage of cluster analysis is

Q72: Which statement is not correct about financial