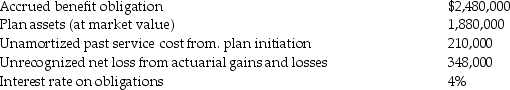

Axel Corporation has a defined benefit pension plan. At January 1,2012,the following balances exist:

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Prepare the journal entry to record pension expense for 2012.

Definitions:

Ending Work in Process

The value of partially completed goods at the end of an accounting period, comprising material, labor, and overhead costs.

Finished Goods Inventory

Unsold goods that are available and ready for purchase in the market.

Cost of Goods Sold

This refers to the direct costs attributable to the production of the goods sold by a company, including the cost of the materials and labor directly used to create the good.

Direct Materials

Raw materials that are directly traceable to the manufacturing of a product and are integral to its production.

Q10: Use the following information to calculate the

Q10: Masons' balance sheet shows a defined benefit

Q10: Explain the meaning of the following terms:

Q31: Which statement is correct about the "if-converted"

Q34: Which statement is not correct?<br>A)A finance lease

Q41: What are "zero-coupon bonds"?<br>A)Bonds that pay the

Q54: _ is a special case of authority,which

Q55: LMN Company reported the following amounts on

Q79: What amount is outside of the corridor

Q93: Which statement is correct?<br>A)Out of the money