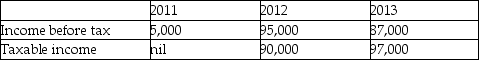

Withering Inc. began operations in 2011. Due to the untimely death of its founder,Edwin Delaney,the company was wound up in 2013. The following table provides information on Withering's income over the three years.

The statutory income tax rate remained at 45% throughout the three years.

The statutory income tax rate remained at 45% throughout the three years.

Requirement:

a. For each year and for the three years combined,compute the following:

- income tax expense under the taxes payable method;

- the effective tax rate (= tax expense -;- pre-tax income)under the taxes payable method;

- income tax expense under the accrual method;

- effective tax rate under the accrual method.

b. Briefly comment on any differences between the effective tax rates and the statutory rate of 45%.

Definitions:

Vascular Cambium

A layer of cells in plants that produces vascular tissues, contributing to the secondary growth in stem and root diameters.

Vascular Bundle

In plants, primary phloem and primary xylem enclosed by a bundle sheath.

Vascular Tissue

Specialized tissue in plants that involves the transport of water and nutrients.

Guard Cells

Specialized cells in the epidermis of leaves and stems that control the opening and closing of stomata to regulate gas exchange.

Q3: Professor Ivan Ishtar copied five pages from

Q10: What is the deferred tax liability under

Q16: Which best summarizes the main goal of

Q22: For each independent situation:<br>1. A customer sued

Q37: Which statement is correct about offsetting?<br>A)It deteriorates

Q54: Explain the nature of current liabilities and

Q54: Calculate the income effect on the incremental

Q55: What is the tax expense under the

Q70: Which is a derivative on the company's

Q84: What is the deferred tax liability under