The following data represent the differences between accounting and tax income for Seafood Imports Inc.,whose pre-tax accounting income is $650,000 for the year ended December 31. The company's income tax rate is 45%. Additional information relevant to income taxes includes the following.

a. Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b. Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

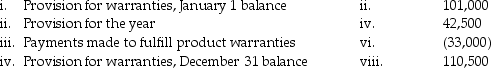

c. In a previous year,the company established a provision for product warranty expense. A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

For tax purposes,only actual amounts paid for warranties are deductible.

d. Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Requirement:

Prepare the journal entries to record income taxes for Seafood Imports.

Definitions:

Performance Objectives

Specific, measurable goals set by an individual or organization to gauge the effectiveness of performance over a period.

Action Steps

Specific, measurable tasks or activities that are planned and executed to accomplish a strategic goal.

Effective Manager

Helps others achieve high levels of both performance and satisfaction.

Stakeholders

Individuals or groups that have an interest in the success and progression of a company, project, or policy.

Q15: scientific misconduct

Q16: What are executory costs?<br>A)Maintenance costs that are

Q20: On June 1,2012,Bean LTD. provides a vendor

Q26: As of January I,2014,the equity section of

Q27: Changing Assumptions Ltd. has the following details

Q33: The following are characteristics of a

Q36: Explain why the IASB requires the disclosure

Q44: Under the accrual method,what is the effect

Q52: What is ethical behaviour regarding the use

Q57: Which statement best explains the concept of