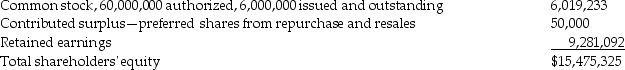

The following is an extract from the balance sheet as at December 31,1011:

at $6 per share,250,000 authorized,25,000 issued and outstanding

at $6 per share,250,000 authorized,25,000 issued and outstanding

The company did not declare dividends on preferred shares in 2011. Transactions in 2012 include the following:

The company did not declare dividends on preferred shares in 2011. Transactions in 2012 include the following:

i. March 15: Hewitt purchased 15,000 preferred shares on the stock exchange for $5.25 per share and held these in treasury.

ii. March 28: The company redeemed 5,000 preferred shares directly from shareholders.

iii. July 1: The market price of common shares shot up to $5 per share,so Hewitt decided to split the common shares two to one.

iv. August 1: Hewitt cancelled 14,000 preferred shares that were held in treasury.

v. December 31: The company declared dividends of $0.40 per common share.

Requirement:

Prepare the journal entries to record the above transactions. The company uses the single-transaction method to account for treasury shares.

Definitions:

Biopower

A term coined by Michel Foucault referring to the practice of modern states and their control over the bodies of individuals, regulating populations through an array of interventions.

Medical Knowledge

The body of information and understanding about human health, diseases, treatments, and medical science acquired through research and clinical practice.

Post-Structuralism

A philosophical and theoretical movement that critiques and extends structuralism, emphasizing the fluidity of meaning and the unreliability of fixed binary oppositions.

Aging Body

Refers to the biological and physiological changes that occur in the human body as it ages, affecting its functionality, health, and appearance.

Q17: Knowing your professional strengths is important to:<br>A)

Q18: After several months in the role of

Q18: On August 15,2011,Madison Company issued 80,000 options

Q20: Tropical Island Inc. (TIl)was incorporated on January

Q22: What do Indigenous peoples who live in

Q25: Terry has become somewhat disillusioned with the

Q68: Which statement is correct about offsetting?<br>A)Offsetting is

Q82: Here are the terms of a

Q84: What is the deferred tax liability under

Q85: In the table below,choose the financial instrument